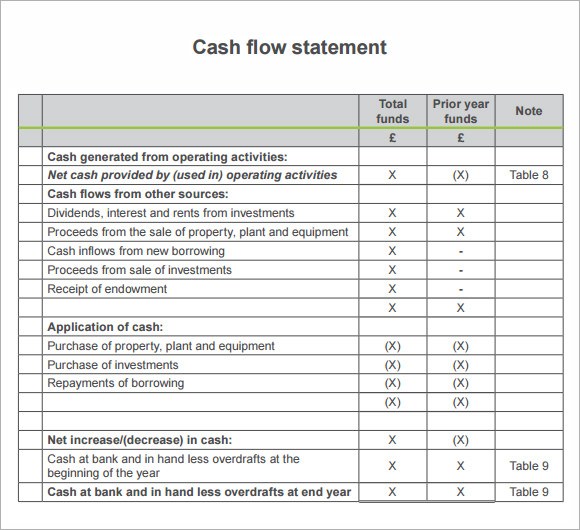

This number will be the same as the cash and account balance shown on the farmer’s balance sheet at the end of the year. The net change in cash balance is added to the beginning cash balance to produce the ending cash balance. The cash from operating activities, cash from investing activities and cash from financing activities are then totaled to produce the net change in cash balance. This figure may be positive or negative, depending on whether you borrowed more funds than repaid or repaid more than was borrowed, and whether you received more gifts and inheritances than were given. These sources and uses are totaled to produce cash from financing activities. Also, cash inflows from gifts and inheritances received and outflows from gifts given are accounted for in financing activities. Cash from financing activitiesĬash is generated by borrowing money and is used in the repayment of principal (the interest portion is an operating expense and has already been counted in the operating farm expenses). The farmer must invest in assets which are expensive and usually by the time they are sold, many are old or obsolete with little value. It is quite common for this cash from investing activities to be a negative figure for farmers because of the nature of the farming business. If it is a negative number, it is using cash. If this total is a positive number, it is contributing cash.

These sources and uses are totaled to produce cash from investing activities.

Cash from investing activitiesĬash is generated by the sale of assets (farm and non-farm) and is used in the purchase of assets (farm and non-farm). If more cash left than came in, then this will be a negative number (not desirable). If earnings (farm and non-farm) bring in more cash than what went out for living and taxes, then cash from operations will be a positive number (desirable). These sources and uses are added to produce cash from operations. Family living takes cash out as does income tax and social security tax. The cash also leaves your life as you pay farm expenses. Cash from operating activitiesĬash from operating activities is cash that came into your life from farm income and from non-farm income. The statement of cash flows is divided into three groups, each examining a different source of and use for cash: cash from operating activities, cash from investing activities and cash from financing activities. This is the cash and account balances that are shown on the balance sheet from the beginning of the year. The statement of cash flows begins by showing the beginning cash balance (farm and non-farm). A complete set of financial statements and proper analysis of them will show financial strengths and weaknesses.

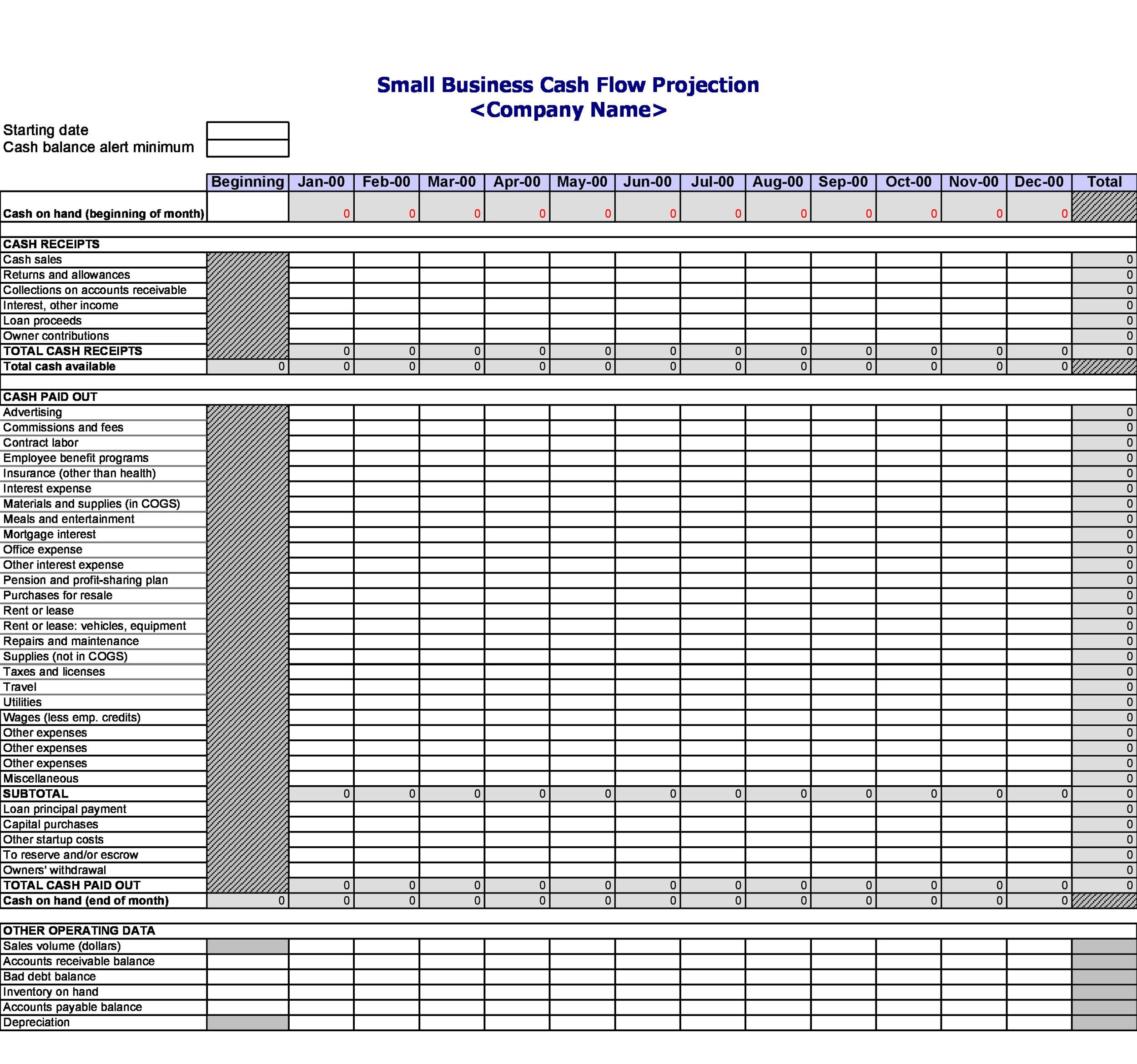

Or, your cash flow could be adequate but profits are lacking. You could have sufficient profits but insufficient cash flow. We need cash to flow into our lives so it is available to cover our family living, to pay our taxes, to service our debt, and to make investments in our business and personal lives.Ĭash flow and net profit are not the same thing. The statement of cash flows examines how cash has entered and left your financial life during the year. FINPACK and other programs can create more detailed cash flows. Example abbreviated statement of cash flows from FINPACK shows cash flows over one year.

0 kommentar(er)

0 kommentar(er)